estate tax changes in 2025

Starting January 1 2026 the exemption will return to 549 million. It could potentially be signed in a different form where the proposed revisions are brought back in.

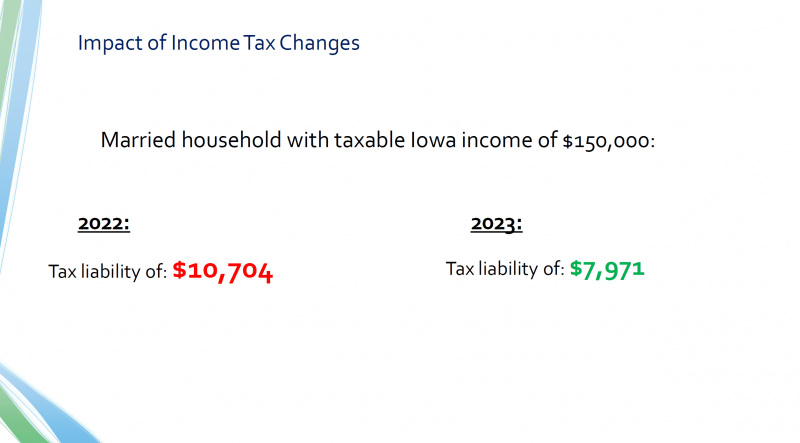

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Second the federal estate tax exemption amount is still dropping on January.

. In a split 106 decision the Tax Court ruled in favor of a taxpayer that the check-the-box CTB regulations do not apply for purposes of valuing the transfer of. For 2022 the basic exclusion amount for a date of death in 2022 is 6110000. Additionally in 10 years the gift.

The TCJA temporarily increased the BEA from 5. The estate tax is imposed on bequests at death as well as inter-vivos during life gifts. The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax.

House located at 2025 NE Bartre Ct Poulsbo WA 98370 sold for 199000 on Sep 8 2003. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. The tax reform legislation raised the estate tax exemption to 1118 million per person and 2236 million per married couple for 2018.

View sales history tax history home value estimates. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Recommended - Free Evaluation Learn About Estate Planning Now.

On the other hand if you held onto those assets and you passed away in 10 years a large portion of the 1964 million would be taxed at 40. 3 beds 2 baths 1897 sq. 115-97 doubled the exemption levels.

Estate Tax Exclusion Change Now and in 2025 Uncategorized Sharon Ravenscroft Wednesday 26 January 2022 399 Hits The estate tax exclusion has increased to 1206. Estate Tax Exclusion Changes Now and in 2025 Jan 28 2022 - News Press Releases Sharon D. We dont make judgments or prescribe specific policies.

The higher levels expire in 2026 but individuals who make large gifts while the exemption is higher and die after it goes back down wont see. For people who pass away in 2022 the. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

New York imposes an estate tax rate between roughly 3 and 16. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. Free Estate Planner Evaluation.

1 2 That was a significant increase. Ravenscroft The estate tax exclusion has increased to 1206 million. See what makes us different.

Dont leave your 500K legacy to the government. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Ad Get free estate planning strategies.

If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. No Changes to the Current Gift and Estate Exemption Provisions Until 2025 The 117M per person gift and estate tax exemption will remain in place and will be increased.

The current estate and gift tax exemption is scheduled to end on the last day of 2025. 11 The Bottom Line Every. The Tax Cuts and Jobs Act of 2017 provides a window of opportunity before 2026 to make use of your personal gift estate exemption of 11580000 2020-adjusted annually.

When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million at the end of 2025 falls to roughly 65. The tax revision of 2017 PL. Ad Recommended -- 4 Simple Steps.

The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted. Because the BEA is adjusted annually for inflation the 2018. At a tax rate of 40 thats a 72 million tax bill.

This increase expires after 2025. After that the exemption amount will drop back down to the prior laws 5 million cap. The exemption was 55 million prior to the law change.

Yahoo Finances recent article IRS Says Millionaires Can Keep Estate Tax Benefits After 2025. Couples can pass on 228 million. How did the tax reform law change gift and estate taxes.

The tax reform law doubled the BEA for tax-years 2018 through 2025. Estate Tax Exemption If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption.

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

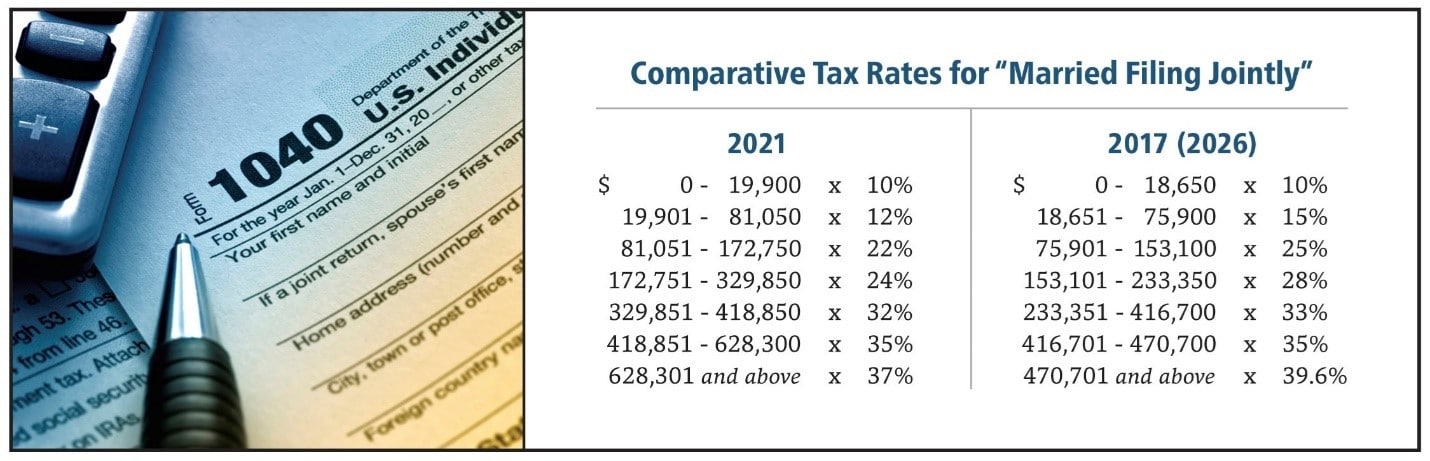

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Could We Reform The Estate Tax Tax Policy Center

What S In The Inflation Reduction Act And What S Next For Its Consideration Bgr Group

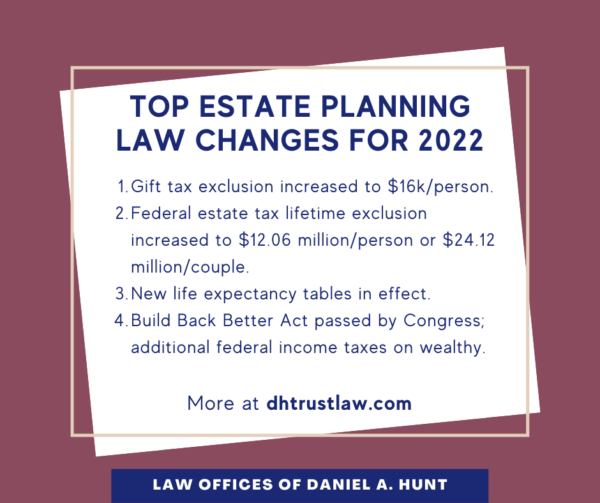

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

The Tax Cuts And Jobs Act Key Changes And Their Impact Bny Mellon Wealth Management

Estate Tax Law Changes What To Do Now

How The Tcja Tax Law Affects Your Personal Finances

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

The Tax Cuts Jobs Act New Rules For Real Estate Owners Bny Mellon Wealth Management

How Could We Reform The Estate Tax Tax Policy Center

Motivational Interviewing Helping People Change 3rd Edition In 2022 Motivational Interviewing Helping People Motivation

What Happened To The Expected Year End Estate Tax Changes

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center